Retaining and motivating Elon Musk is vital if Tesla is to become the most valuable company in history,” Tesla Chairwoman Robyn Denholm said.

Elon Musk – the richest man on the planet – is on the verge of becoming the first trillionaire in history, thanks to a huge stock bonus package that Tesla’s board of directors just presented to shareholders.

However, behind that staggering figure lies a risky bet for the future of the electric car company.

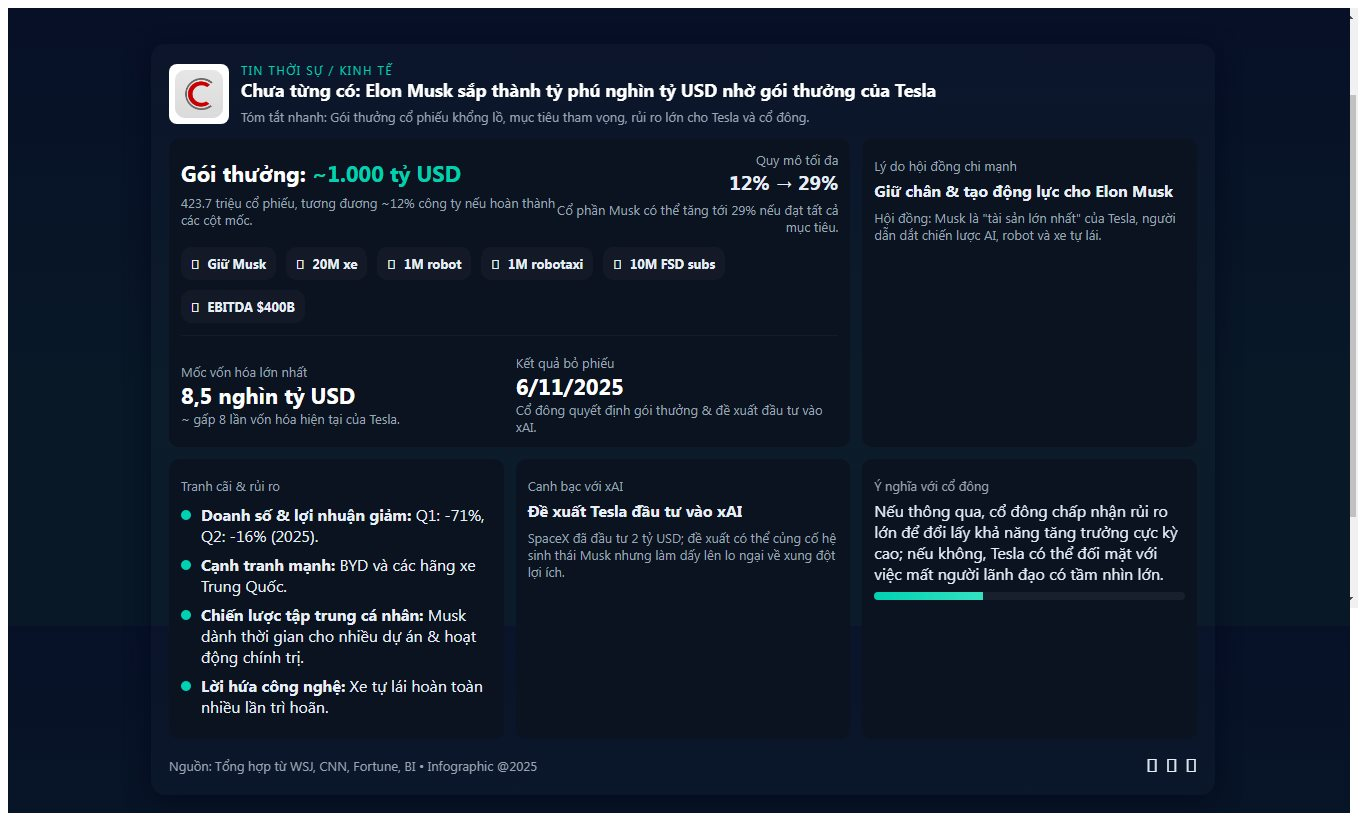

According to financial filings released over the weekend, Elon Musk could receive 423.7 million Tesla shares – equivalent to about $1 trillion – if the company hits “huge” growth milestones over the next 10 years.

The ultimate goal: to boost Tesla’s market capitalization to $8.5 trillion, nearly eight times its current value.

If achieved, Musk’s stake in Tesla would increase from about 13% to 29%, cementing his voting power and leadership position.

In addition to capitalization requirements, Musk must achieve a series of ambitious goals such as delivering 20 million cars/year, deploying 1 million robots and 1 million commercial robotaxes, reaching 10 million Full Self Driving service subscribers, and increasing adjusted EBITDA to 400 billion USD, more than 20 times the 2024 level.

However, another factor that makes Tesla spend a lot of money is trying to retain and keep Elon Musk.

“Retaining and motivating Elon Musk is vital if Tesla is to become the most valuable company in history,” Tesla Chairwoman Robyn Denholm said.

To the board, Elon Musk is not only the CEO but also the “biggest asset” – the person capable of leading Tesla in the race for AI, robots and self-driving cars.

The world’s richest billionaire once declared that he needs at least 25% of the voting rights to direct strategy, otherwise he will “build products outside Tesla”.

But the package has been deeply divisive, with some analysts warning that the $8.5 trillion target is unrealistic given Tesla’s challenges.

The company’s sales and profits fell sharply by 71% in the first quarter of 2025 and 16% in the second quarter, mainly due to fierce competition from Chinese electric car makers such as BYD, and the loss of revenue from selling emissions credits due to changes in US law.

In addition, the company is also being negatively affected by Elon Musk’s political statements and activities.

In addition, Musk has a history of promising fully self-driving cars since 2014 but has not yet delivered, causing critics to worry that Tesla is pursuing more of a vision than a practical solution.

Critics also say the compensation package will cause Musk to focus on inflating the stock price rather than addressing the company’s core issues.

Furthermore, many of Musk’s promises about self-driving technology have failed to materialize in the past, leading some experts to call him a “master market manipulator.”

“Elon Musk has been saying since 2014 that we’re going to have a fully autonomous car next year.

That hasn’t happened yet, but that promise has been valued by Wall Street for billions of dollars,” said analyst Gordon Johnson, one of Tesla’s fiercest critics. “Elon Musk is a master manipulator.

He keeps the stock high. The reason the board pays him is because he’s willing to say things that other CEOs don’t dare say or can’t get away with.”

Gamble

Returning to the bonus package, the shareholder filing also includes a proposal for Tesla to invest in xAI – Musk’s artificial intelligence company, after SpaceX poured $2 billion into it.

This move could help Musk consolidate his business empire spanning electric cars, space, social networks and AI.

Tesla shareholders will vote on the compensation package and xAI investment proposal on November 6.

The outcome will not only determine Musk’s financial future but also shape Tesla’s direction for the next decade.

To fans, it was a fitting reward for a strategist who had turned Tesla into the world’s No. 1 electric carmaker.

But to skeptics, it was a testament to the boldness—even risk—of a company willing to bet on an individual, regardless of the risks.

Despite the controversy, Tesla has maintained its absolute faith in its CEO, saying that only Musk can lead the company to achieve its “long-term mission at an unprecedented level.”

The upcoming shareholder vote will determine whether Musk receives this dream compensation package, and whether history will record him as the world’s first trillionaire.