The simmering tensions between Elon Musk and President Donald Trump’s inner circle have reached a boiling point, with Trump’s top trade adviser, Peter Navarro, publicly dismissing the Tesla CEO as nothing more than “a car assembler” and making clear that Musk’s influence in the White House has all but evaporated.

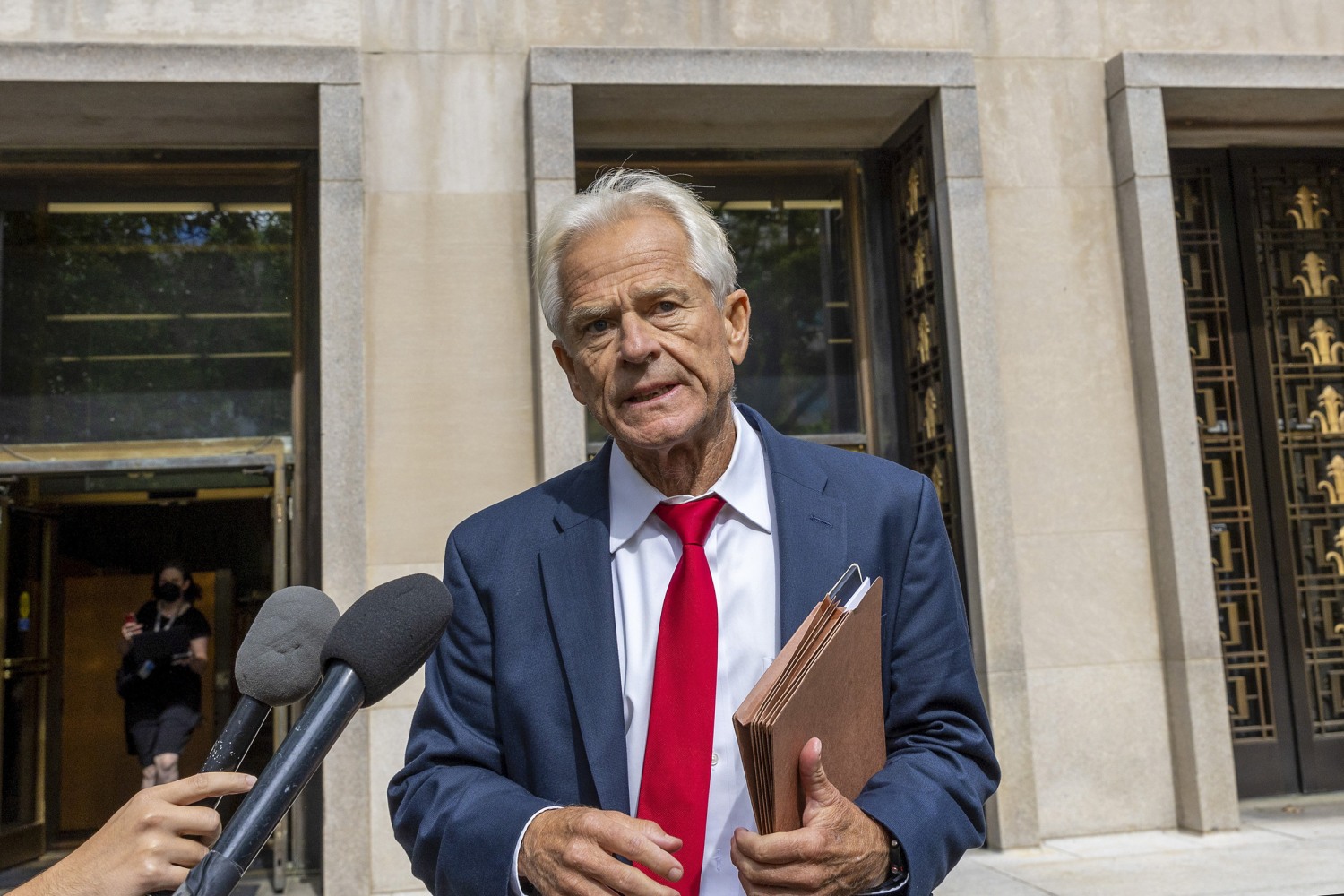

In a pointed interview with CNBC on Monday, Navarro mocked Musk’s recent comments promoting “zero tariffs” between the United States and Europe, calling the billionaire’s stance unsurprising for someone whose business relies heavily on foreign-made parts.

The attack underscores Musk’s diminishing standing within the Trump administration, once seen as a powerful ally in Silicon Valley, now openly derided by senior figures in the President’s economic team.

“He’s a car person. That’s what he does, and he wants the cheap foreign parts,” Navarro said. “But when it comes to tariffs and trade, Elon is not a car manufacturer. He’s a car assembler.”

The remarks reflect more than a personal spat — they signal a dramatic rift in the once-functional relationship between Musk and the Trump administration. With Musk calling for free trade and zero tariffs, and Navarro advocating full-blown economic nationalism, the battle lines are now clearly drawn.

For much of Trump’s first and early second term, Elon Musk maintained a unique, if informal, position as a high-profile adviser and occasional emissary for technological innovation. From meetings on infrastructure and deregulation to collaboration on space and energy policy, Musk’s input was regularly sought — and often spotlighted.

But those days appear to be over.

According to multiple sources close to the administration, Musk has been increasingly sidelined in internal discussions, particularly those related to trade and manufacturing — two areas where his vision of a global supply chain and free-market trade runs directly counter to Trump’s “America First” economic policy.

“Elon has no seat at the table anymore,” said one senior White House official speaking on background. “Once tariffs became the core of the President’s strategy, his voice became less relevant — and less welcome.”

Peter Navarro, widely considered the architect behind Trump’s aggressive tariff regime, did not mince words in his CNBC appearance. Dismissing Musk’s suggestion that the U.S. and EU create a “zero tariff” free-trade zone, Navarro accused Musk of wanting to preserve access to low-cost foreign parts for his electric vehicles.

“We want the tires made in Akron. We want the transmissions made in Indianapolis. We want the engines made in Flint and Saginaw,” Navarro said. “We want the cars manufactured here.”

It was a full-throated defense of the Trump administration’s effort to reshore industrial production — and a blunt rejection of the globalized production model that Tesla has embraced. Tesla sources components from a wide range of countries, including Japan, China, and Taiwan. While the company has made efforts to localize certain elements of its supply chain, it remains a multinational operation, one that does not fit the mold Navarro promotes.

By labeling Musk “a car assembler,” Navarro not only aimed to diminish Musk’s industrial credibility but to signal to Trump’s base that the administration views Musk as misaligned with their nationalist economic goals.

Just days before Navarro’s comments, Musk appeared via video at an event hosted by Italy’s right-wing League Party, where he advocated for the United States and Europe to pursue a zero-tariff regime. “I hope that Europe and the U.S. can agree to a zero tariff situation, effectively creating a free trade zone,” Musk said.

It was a direct counterpoint to the Trump administration’s announcement of new reciprocal tariffs on nearly 60 countries — a policy Navarro has been central in designing and defending.

Musk’s remarks received applause in Europe, but in Washington, they only served to deepen the divide. “That’s not the direction we’re going,” said a White House official. “This administration believes in controlled trade, in fairness, and in protecting American manufacturing. Elon’s vision may work for a tech startup — not for a country.”

At the heart of this feud are two fundamentally different visions of economic strategy. Musk, like many Silicon Valley leaders, sees global integration, trade liberalization, and innovation-driven scale as the pillars of future prosperity. Navarro and the Trump camp, by contrast, see those same forces as responsible for America’s industrial decline and vulnerable supply chains.

Navarro’s policy approach calls for higher tariffs, reshoring manufacturing, and reducing reliance on countries like China. He’s repeatedly stated that the COVID-19 pandemic and global instability have proven that dependency on foreign suppliers is a national security risk. For Navarro and Trump, Elon Musk — despite his success — is emblematic of a system they want to dismantle.

“This is not personal,” said Navarro on CNBC. “It’s about policy. It’s about putting American workers first.”

Still, the personal jabs have stung. In Washington, Navarro’s “car assembler” line is seen as more than an offhand remark — it’s a calculated move to redefine Musk’s public image and reduce his credibility on manufacturing and trade policy.

The rhetoric is not just symbolic. Tesla has seen its market cap battered in recent weeks amid uncertainty surrounding tariffs and a shifting global trade environment. With critical components like lithium-ion batteries and semiconductors coming from overseas, any disruption in trade routes or added import costs could directly affect Tesla’s bottom line — and its competitiveness in the EV market.

Industry analysts say that while Musk has reason to be concerned, his business model is fundamentally out of sync with the Trump administration’s direction.

“Tesla is global by design. Navarro’s America is not,” said Rachel Fong, a senior analyst at Polaris Research. “This rift was inevitable.”

While the President himself has yet to comment on Navarro’s remarks or Musk’s diminished presence, it’s clear that the dynamic between Trump and Musk has shifted. Trump has previously praised Musk as a “brilliant guy” and “American success story.” But in recent months, that praise has been more muted — and now, with key voices like Navarro pushing him aside, Musk’s policy influence appears all but gone.

Behind closed doors, Trump has reportedly grown weary of what one adviser described as “Elon’s globalist leanings.” With the 2024 campaign in full swing and economic nationalism forming a key pillar of his platform, Trump may no longer see value in aligning himself with Silicon Valley’s most high-profile capitalist.

Musk, for his part, has not publicly responded to Navarro’s remarks — an unusual silence for a CEO known for his unfiltered social media commentary. Whether this signals a deliberate step back from political engagement, or a strategic pause before responding, remains to be seen.

But political observers believe this public distancing may be permanent. “This isn’t just a feud,” said Dr. Steven Lang, professor of political economy at George Washington University. “It’s a divorce of convenience. Musk needed access, Trump needed tech credibility. That moment has passed.”

With tariffs expanding, Musk’s free trade message gaining little traction, and Navarro firmly in the driver’s seat, the message from the White House is unmistakable: Elon Musk is no longer part of the conversation — and calling him a “car assembler” is just the punctuation mark on that decision.